Smith And Wesson Stock: Throughout most of its history, the company formerly known as Smith & Wesson Holdings was best known for its guns. Yet despite its legacy as a gunmaker, Smith & Wesson worked hard to broaden its business to include products such as flashlights, knives, tools, and vault accessories. As a result, Smith & Wesson decided to change its name to American Outdoor Brands (NASDAQ: AOBC), also changing its ticker symbol and ushering in a new chapter for the company.

Let’s look at Smith & Wesson’s stock history and how the company will continue seeking growth under the American Outdoor Brands name.

Smith And Wesson Stock Price

American Outdoor Brands reported quarterly earnings and sales that beat expectations, pushing the stock sharply higher late Thursday.

The maker of Smith & Wesson firearms said it earned $7.6 million in net income during the company’s fiscal first quarter, bouncing back from a loss of $2.2 million in the same period a year ago. Excluding one-time items, adjusted earnings-per-share climbed to 21 cents from 2 cents. Wall Street analysts had estimated an adjusted profit of 12 cents a share.

Net sales jumped 7.6 percent to $138.8 million, surpassing the consensus estimate of $134.5 million. The firearms segment saw revenue grow 5.9 percent.

American Outdoor Brands also issued guidance for second-quarter earnings of 11 cents to 15 cents a share. That’s better than the 8 cents a share that analysts anticipated.

Smith and Wesson a publicly-traded company?

What firearm companies are publicly traded?

- American Outdoor Brands (NASDAQ: AOBC): up 54%

- Sturm, Ruger (NYSE: RGR): up 23%

- Vista Outdoor (NYSE: VSTO): up 17%

What is the stock symbol for Glock?

| Company | Stock Ticker | Market Cap |

|---|---|---|

| Sturm, Ruger | NYSE: RGR | $1.2 billion |

| Smith & Wesson | NASDAQ: SWHC | $1.5 billion |

| Vista Outdoor | NYSE: VSTO | $2.9 billion |

Smith And Wesson Stock Symbol

Smith And Wesson Stock Chart

The Smith and Wesson are one of the most popular gun brands in the world, and for decades, the company that made those guns had that brand as its corporate name. Yet along the way, Smith and Wesson made strategic acquisitions and developed ancillary parts of its business, and that has led the company to make a lot more than just guns. In response to this changed focus, Smith and Wesson are now known as American Outdoor Brands (NASDAQ: AOBC).

As the company goes forward, investors want to know whether Smith and Wesson are making a smart move or whether it’s distancing itself from its best-known product line at a time when the American political climate is near its most favorable for gun owners. Let’s look more closely at how the stock has performed over time and whether American Outdoor Brands will successfully carry the Smith and Wesson tradition into the future.

Smith And Wesson Stock Ticker

In a statement, American Outdoor Brands CEO James Debney attributed the earnings increase to a decline in promotional discounts, cost cuts and robust consumer demand for new Smith & Wesson products.

| Ticker | Security | Last | Change | %Chg |

|---|---|---|---|---|

| AOBC | AMERICAN OUTDOOR BRANDS | 6.71 | -0.19 | -2.75% |

| RGR | STURM RUGER | 44.09 | -0.32 | -0.72% |

American Outdoor Brands has sought to diversify its product portfolio in an effort to reduce its exposure to the gun industry’s boom-and-bust cycles. The company has made several acquisitions in recent years including Crimson Trace, which makes laser sights.

Gun demand was strong in the months leading up to the 2016 presidential election, but sales have turned soft since President Donald Trump took office, as buyers have become less concerned about new restrictions. During American Outdoor Brands’ previous fiscal year, revenue from the sale of long guns fell 50 percent compared to the previous year, according to data cited by The Wall Street Journal. Sturm, Ruger & Co. has also seen a decline in sales.

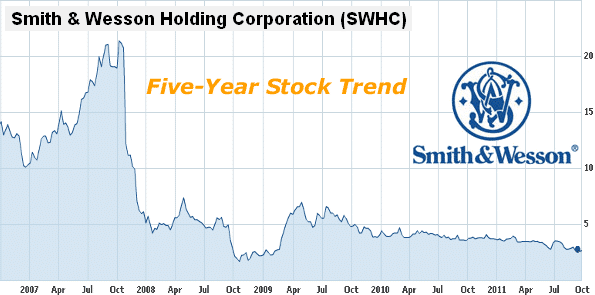

Smith And Wesson Stock Price History

Smith & Wesson stock produced huge returns for early shareholders. Since early 2000, Smith & Wesson climbed at an average 19% annual rate. However, those gains didn’t come in a straight line. Smith & Wesson almost went out of business in 2000, as customers reacted negatively to Smith & Wesson’s efforts to spearhead gun safety innovations like locking devices and limitations on sales. A boycott from the National Rifle Association showed Smith & Wesson the error of its ways, as customers felt betrayed by the company’s perceived failure to advocate for gun rights by caving into political and regulatory demands.

Longtime investors in Smith and Wesson have reaped the rewards of the gunmaker’s success, but they’ve had to be resolute in order to enjoy them. Beginning in 2005, the stock went on a roughly three-year run that lifted the shares tenfold, as concerns arose about whether tighter gun control laws might restrict the rights of gun owners to purchase new weapons. That led to a dramatic upsurge in demand. But as gun sales fell back from those levels during the recession, the stock price receded as well.

The stock has shown similar behavior since then. After tragic events involving mass shootings in several places, calls for greater gun control measures get louder, and sales of guns get a temporary uptick. Yet when any subsequent regulatory measures prove to be less stringent than feared, gun stocks have typically given up considerable ground.

Read Also: –Wrigley Field Renovations

The latest example of this phenomenon came in the 2016 election, in which many feared that Democratic candidate Hillary Clinton would win and usher in a new era of stringent gun regulation. The election of Republican Donald Trump instead put gun owners at ease and lessened the urgency for them to accelerate gun purchases.

Since then, Smith & Wesson’s stock has seen several spikes. The first came in the run-up to the 2008 presidential election, and the Democratic victory brought fears that increased gun regulation would prevent buyers from acquiring guns in the near future. In anticipation of such an adverse event, gun buyers stocked up early, and that led to huge sales for Smith & Wesson and its gun-making peers.

However, that run-up for the stock proved short-lived. Major changes in gun regulation never came, and the sales glut led to lower demand in the following years. The stock slumped for several years following 2008, in part because of the recession and financial crisis that sapped consumer spending strength throughout the economy.