Receivables Turnover Ratio: Divide net credit sales by average account receivables to calculate the Accounts Receivables. The ratio is used to measure how effective a company is at extending credits and collecting debts. Generally, the higher the accounts receivable turnover ratio, the more efficient your business is at collecting credit from your customers.

When it comes to business accounting, there are many formulas and calculations that, although seemingly complex, can nevertheless provide valuable insight into your business operations and financials. One such calculation, the accounts receivable turnover ratio, can help you determine how effective you are at extending credit and collecting debts from your customers.

Even though this may sound difficult, once you break down the accounts receivable turnover formula, you’ll find that the ratio is, in fact, rather simple to calculate. Moreover, the accounts receivable turnover ratio can be extremely useful—as understanding it can be crucial to your cash flow, to getting a loan, and to your overall business financial planning.

In this guide, therefore, we’ll break down the accounts receivable turnover ratio, discussing what it is, how to calculate it, and what it can mean for your business.

Read Also: What Is The Fraud Triangle?

The accounts receivable turnover ratio is an accounting measure to quantify a company’s effectiveness in collecting its receivables. The ratio shows how well a company uses and manages credit. As well as extends to customers and how quickly that short-term debt is paid. The receivables turnover ratio is also called the accounts receivable turnover ratio.

Receivables Turnover Ratio Formula

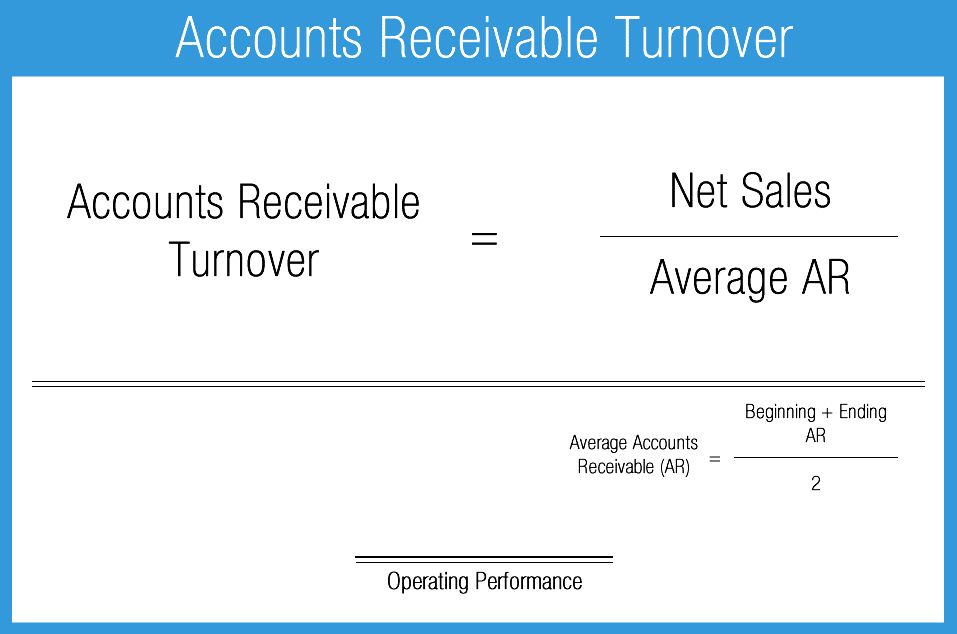

In order to calculate your accounts receivable turnover ratio, you’ll use the following accounting receivable turnover formula:

Net credit sales / Average Accounts Receivable

Step 1: Determine your net credit sales.

The first part of the accounts receivable turnover formula calls for your net credit sales, or in other words, all of your sales for the year that were made on credit (as opposed to cash). This figure should include your total credit sales, minus any returns or allowances. You should be able to find your net credit sales number on your annual income statement or on your balance sheet.

Step 2: Determine your average accounts receivable.

Once you have your net credit sales, the second part of the accounts receivable turnover formula requires your average accounts receivable. Accounts receivable refers to the customer’s money owed to you. In order to find your average accounts receivable, then, you’ll take the number of your accounts receivable at the beginning of the year, add it to the value of your accounts receivable at the end of the year, and divide it by two to find the average. You should be able to find the necessary accounts receivable numbers on your balance sheet.

Step 3: Divide.

Once you have these two values, you’ll be able to use the accounts receivable turnover formula. You’ll divide your net credit sales by your average accounts receivable to calculate your accounts receivable turnover ratio or rate.

Read Also: Who Is Friedlieb Ferdinand Runge?

As a reminder, this ratio helps you look at the effectiveness of your credit. As your net credit sales value does not include cash since cash doesn’t create receivables. Therefore, if you have a lower number of payment collections from your customers. You’ll have a lower accounts receivable turnover ratio, and vice versa. If you have a higher number of payment collections from customers, you’ll have a higher ratio.

Receivables Turnover Ratio Calculator

Companies maintaining accounts receivables are indirectly extending interest-free loans to their clients. And accounts receivable are considered as money owed without interest. If a company generates a sale to a client, it could extend terms of 30 or 60 days, meaning the client has 30 to 60 days to pay for the product.

- Add the value of accounts receivable at the beginning of the desired period. To the value at the end of the period and divide the sum by two. The result is the denominator in the formula.

- Divide the value of net credit sales for the period by the average accounts receivable during the same period.

- Revenue generated from sales on credit minus any returns from customers defines Net credit sales.

The receivables turnover ratio measures the efficiency a company collects on its receivables or credit it had extended to its customers. The ratio also converted cash from the company’s receivables in a period. The receivables turnover ratio could be calculated on an annual, quarterly, or monthly basis.

Read Also: Smith And Wesson Stock

How To Calculate Receivables Turnover Ratio

The accounts receivable turnover in days shows the average number of days. It takes a customer to pay the company for sales on credit.

The formula for the accounts receivable turnover in days is as follows:

Receivable turnover in days = 365 / Receivable turnover ratio

Determining the accounts receivable turnover in days for Trinity Bikes Shop in the example above:

Receivable turnover in days = 365 / 7.2 = 50.69

Therefore, the average customer takes approximately 51 days to pay their debt to the store. If Trinity Bikes Shop maintains a policy for payments made on credit such as a 30-day policy. The receivable turnover in days calculated above would indicate that the average customer makes late payments.