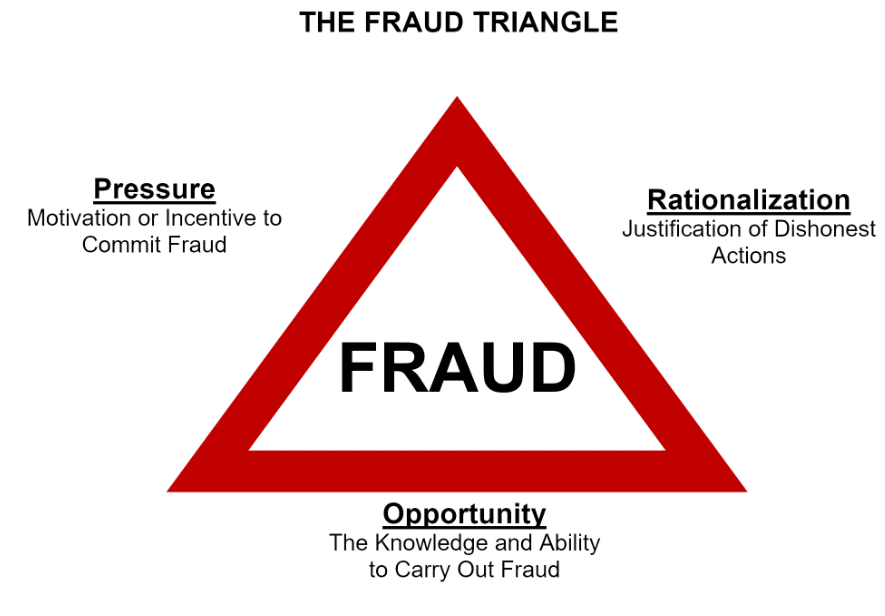

Fraud Triangle: The fraud triangle is comprised of three conditions that increase the likelihood of fraud being committed. The three components of the fraud triangle are:

- Perceived pressure. A person may be liable for significant liabilities, such as the cost of supporting sick relatives, college loans, car loans, and so forth. Or, they may have an expensive habit that requires ongoing funding. When the individual sees no way out of the situation, they may resort to fraud. However, there may only be a perceived level of pressure, such as earning comparatively less than one’s friends. This latter situation can trigger expectations for a better lifestyle, perhaps involving a sports car, foreign travel, or a larger house. When a person does not see a clear path to meeting these expectations by honest means, he or she may resort to dishonest alternatives.

What Is The Fraud Triangle? - Opportunity. When the preceding pressures are present, a person must also see an opportunity to commit fraud. For example, a maintenance worker may realize that there are no controls over checking out and returning tools; this is an opportunity for theft.

- Rationalization. An additional issue that is needed for fraud to continue over a period of time is the ability of the perpetrator to rationalize the situation as being acceptable. For example, a person stealing from a company’s petty cash box might rationalize it as merely borrowing, with the intent of paying back the funds at a later date. As another example, a management team adjusts reported earnings for a few months during mid-year, in the expectation that sales will rise towards the end of the year, allowing them to eliminate the adjustments by year-end.

Which Of The Following Is Not An Element Of The Fraud Triangle?

To fight fraud one must not only realize that it occurs but also how and why it occurs. Several decades ago, after considerable research, Donald R. Cressey, a well-known criminologist, developed the Fraud Triangle. Interested in the circumstances that led embezzlers to temptation, he published Other People’s Money: A Study in the Social Psychology of Embezzlement.

Cressey’s hypothesis was: “Trusted persons become trust violators when they conceive of themselves as having a financial problem which is non-shareable, are aware this problem can be secretly resolved by a violation of the position of financial trust, and are able to apply to their own conduct in that situation verbalizations which enable them to adjust their conceptions of themselves as trusted persons with their conceptions of themselves as users of the entrusted funds or property.”

Essentially, the three elements of the Fraud Triangle are Opportunity, Pressure (also known as incentive or motivation), and Rationalization (sometimes called justification or attitude). For fraud to occur, all three elements must be present.

The Most Important Element Of The Fraud Triangle

The Fraud Triangle is a framework designed to explain the reasoning behind a worker’s decision to commit workplace fraud. The three stages, categorized by the effect on the individual, can be summarised as pressure, opportunity, and rationalization. Broken down, they are:

- Step 1 – the pressure on the individual – is the motivation behind the crime and can be either personal financial pressure, such as debt problems, or workplace debt problems, such as a shortfall in revenue. The pressure is seen by the individual as unsolvable by orthodox, legal, sanctioned routes, and unshareable with others who may be able to offer assistance. A common example of a perceived unshareable financial problem is gambling debt. Maintenance of a lifestyle is another common example.

- Step 2 – the opportunity to commit fraud – is the means by which the individual will defraud the organization. In this stage, the worker sees a clear course of action by which they can abuse their position to solve the perceived unshareable financial problem in a way that – again, perceived by them – is unlikely to be discovered. In many cases, the ability to solve the problem in secret is key to the perception of a viable opportunity.

- Step 3 – the ability to rationalize the crime – is the final stage in the fraud triangle. This is a cognitive stage and requires the fraudster to be able to justify the crime in a way that is acceptable to his or her internal moral compass. Most fraudsters are first-time criminals and do not see themselves as criminals, but rather as victims of circumstance. Rationalizations are often based on external factors, such as a need to take care of a family, or a dishonest employer which is seen to minimize or mitigate the harm done by the crime.

Read Also:- Why Did Wonga UK Collapse

The term fraud triangle was first coined by American sociologist Donald R. Cressey who worked extensively in the fields of criminology and white-collar crime. Fraud is often a white-collar crime but not always.

What are the 3 elements of the fraud triangle?

What is the fraud triangle in auditing?

What is the fraud theory?

Fraud Triangle Accounting/Fraud Triangle Theory

One of the older and more basic concepts in fraud deterrence and detection is the “fraud triangle.” While researching his doctoral thesis in the 1950s, famed criminologist Donald R. Cressey came up with this hypothesis to explain why people commit fraud.

The three key elements in the fraud triangle are opportunity, motivation, and rationalization. Opportunity is the element over which business owners have the most control. Limiting opportunities for fraud is one way a company can reduce it.

The opportunity to commit fraud is possible when employees have access to assets and information that allows them to both commit and conceal the fraud. Employees are given access to records and valuables in the ordinary course of their jobs. Unfortunately, that access allows people to commit fraud. Over the years, managers have become responsible for a wider range of employees and functions. This has led to more access for them, as well as more control over the functional areas of companies. Access must be limited to only those systems, information, and assets that are truly necessary for an employee to complete his or her job.

Motivation, another aspect of the fraud triangle, is a pressure or a “need” felt by the person who commits fraud. It might be a real financial or other type of need, such as high medical bills or debts. Or it could be a perceived financial need, such as a person who has a desire for material goods but not the means to get them.

Read Also: Operating Income Formula

Motivators can also be non-financial. There may be high pressure for good results at work or a need to cover up someone’s poor performance. Addictions such as gambling and drugs may also motivate someone to commit fraud.

Lastly, employees may rationalize this behavior by determining that committing fraud is OK for a variety of reasons. For those who are generally dishonest, it’s probably easier to rationalize fraud. For those with higher moral standards, it’s probably not so easy. They have to convince themselves that fraud is OK with “excuses” for their behavior.

Common rationalizations include making up for being underpaid or replacing a bonus that was deserved but not received. A thief may convince himself that he is just “borrowing” money from the company and will pay it back one day. Some embezzlers tell themselves that the company doesn’t need the money or won’t miss the assets. Others believe that the company “deserves” to have money stolen because of bad acts against employees.

Business owners and executives must take control of fraud by working on the portion of the fraud triangle over which they have the most control: the opportunity to commit fraud. It may be difficult for management to do anything about an employee’s needs or rationalizations, but by limiting opportunities for fraud, the company can reduce it to some extent.

The Fraud Triangle Applies To

Opportunity

If one is talking about theft, there must be something to steal and a way to steal it. Anything of value is something to steal. Any weakness in a system—for example, lack of oversight—is a way to steal. Of the three elements of the Fraud Triangle, the opportunity is often hard to spot, but fairly easy to control through organizational or procedural changes.

Pressure

Pressure, in this case, is another way of saying motivation. What is it in one’s life that drives one to commit fraud? Pressure sometimes involves personal situations that create a demand for more money; such situations might include vices like drug use or gambling or merely life events like a spouse losing a job. At other times, pressure arises from problems on the job; unrealistic performance targets may provide the motive to perpetrate fraud.

Rationalization

There are two aspects to a rationalization: One, the fraudster must conclude that the gain to be realized from a fraudulent activity outweighs the possibility of detection. Two, the fraudster needs to justify the fraud. Justification can be related to job dissatisfaction or perceived entitlement, or a current intent to make the victim whole sometime in the future, or saving one’s family, possessions, or status. Rationalization is discernible by observation of the fraudster’s comments or attitudes.

Capability

The Fraud Diamond, a newer theory of fraud proposed by David T. Wolfe and Dana R. Hermanson, asserts that the fraudster’s capability must also be taken into account. The fraudster, it is said, must have the required traits (e.g., greed, weakness of character, excessive pride, dishonesty, etc.) and abilities (e.g., knowledge of processes and controls) to actually commit the fraud. It can be argued, however, that traits are components of pressure and that abilities are opportunity factors.

10-80-10 Rule*

The 10-80-10 Rule supports the general assumption of capability by the breakdown of the population and the likelihood of fraud occurrences. Essentially:

- 10 percent of the population will NEVER commit fraud. This is the type of person that will go out of their way to return items to the correct party.

- 80 percent of the population might commit fraud given the right combination of opportunity, pressure, and rationalization.

- 10 percent of the population is actively looking at systems and trying to find a way to commit fraud.

*Source: National Association of State Auditors, Comptrollers, and Treasurers (NASACT) and the Oregon State Controller’s Division

What Is The Fraud Triangle?

Fraud deterrence has gained public recognition and spotlight since the 2002 inception of the Sarbanes-Oxley Act. Of the many reforms enacted through Sarbanes-Oxley, one major goal was to regain public confidence in the reliability of financial markets in the wake of corporate scandals such as Enron, WorldCom, and Waste Management. Section 404 of Sarbanes Oxley mandated that public companies have an independent Audit of internal controls over financial reporting. In essence, the intent of the U.S. Congress in passing the Sarbanes Oxley Act was attempting to proactively deter financial misrepresentation (Fraud) in order to ensure more accurate financial reporting to increase investor confidence. This same concept is applied in the discussion of fraud deterrence.