Have you ever been asked to submit a canceled cheque while availing key financial services such as credit cards, loan applications, and buying items on EMIs? If yes, then you may have an idea for what purposes it is required.

If not, then you should know that a canceled cheque is needed to indulge in the smooth processing of your application for multiple services as it is a compliance norm.

To avoid asking again for your bank details, service providers need a canceled cheque to go with the Know Your Customer (KYC) procedures.

If you don’t know how to cancel a cheque, then here is a quick post to help you understand the basics around it. Continue reading!

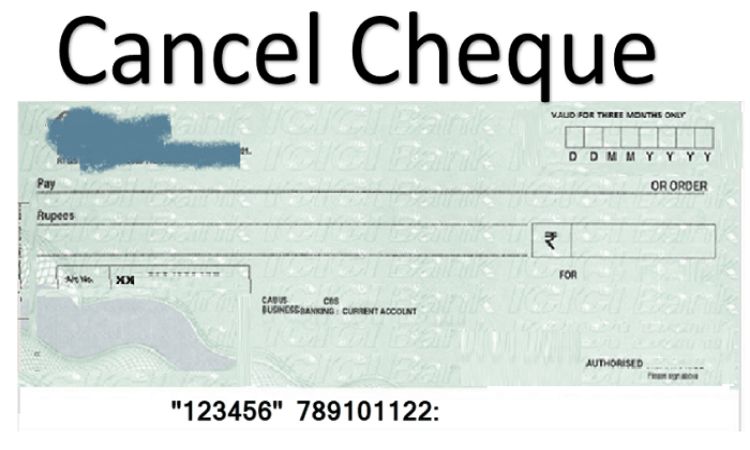

How to cancel a cheque?

Canceling a cheque and providing it as a KYC norm is easy to do. Here are the steps that you can follow to do that successfully:

- Take a cheque leaf out of your checkbook issued by your bank

- Draw two lines parallel so that there is some space left

- Use the space to write the word ‘Cancelled’

- You should write the word ‘Cancelled’ in such a way that no printed bank details get obstructed

- You can take a blue or black pen to cancel a cheque

- It is up to you to write the word ‘Cancelled’ either in bold as CANCELLED or in sentence case such as Cancelled

While issuing anyone or a service provider a canceled cheque, you should ensure not to sign it. It is because a canceled cheque does not come with any monetary value. It means that you can’t use it to withdraw or receive any amount.

There have been some instances of fraud concerning canceled cheques in the past as it contains your bank account details, hence; you should refrain from signing on them.

What information does a canceled cheque contain?

If you want to know what information is contained in a canceled cheque, have a look:

- Contains the name of your cheque issuing bank

- It comes with the account holder’s name

- Has the account number of the user

- You will also find the IFSC Code of the bank and its complete branch address

- It will also have the MICR Code of the bank

For what purposes does a canceled cheque get issued?

When you decide to avail of some financial services such as loans, credit cards, ECS, or buying products on EMIs, your service providers may need to verify your bank details. While giving them the bank details, you may make some mistakes, and then they may have to contact you for correct details again – leading to more turnaround time. Hence, to avoid all these issues, they ask you to provide them with a canceled cheque. Why? It is because a canceled cheque comes with all bank account details as mentioned easier. And it makes the processing of the required services as well as KYC smooth.

Read Also: QuickBooks Error 1324 | How to Solve

Other than the mentioned services. You may also be asked to submit a canceled cheque to your company while applying for PF withdrawal. It is done to ensure that the PF amount is being credited only into the right bank account. You may also be required to submit a canceled cheque while setting up for a specific amount to be debited from your bank account against a service.

Overall, issuing a canceled cheque is a typical way to authenticate your bank account information. So you can avail of that service without delays. You are now aware of how to cancel a cheque and will now do that correctly.