How To Use Quickbooks: QuickBooks is a small business accounting software program businesses use to manage sales and expenses and keep track of daily transactions. You can use it to invoice customers, pay bills, generate reports for planning, tax filing, and more. The QuickBooks product line includes several solutions that work great for anyone from a solo preneur to mid-sized business.

Since there are several QuickBooks solutions, it’s important that you pick the right one. Before you commit, take QuickBooks for a spin by signing up for a free 30-day trial; the trial is a fully-functional version of QuickBooks, so you can test all of the bells and whistles. Best of all, no credit card is required.

Is QuickBooks difficult to learn?

Learning QuickBooks or any other software is not hard at all, however, unleashing the right way to do accounting tasks on it is somehow tricky. So, learning QuickBooks is easy. It’s a simple practice you have to make daily so as to learn new ways of handling it.

What is QuickBooks and how do you use it?

QuickBooks is a small business accounting software program businesses use to manage sales and expenses and keep track of daily transactions. You can use it to invoice customers, pay bills, generate reports for planning, tax filing, and more.

How can I learn QuickBooks for free?

- QuickBooks Tutorials. When you’re looking for information on a program, sometimes it’s best to turn to the unicorn that began it all.

- QuickBooks Learning Center.

- QuickBooks-Training.net.

- QuickBooks Training.

- Fit Small Business.

- GCF Learn Free.

- QuickBooks Explained.

- Udemy.

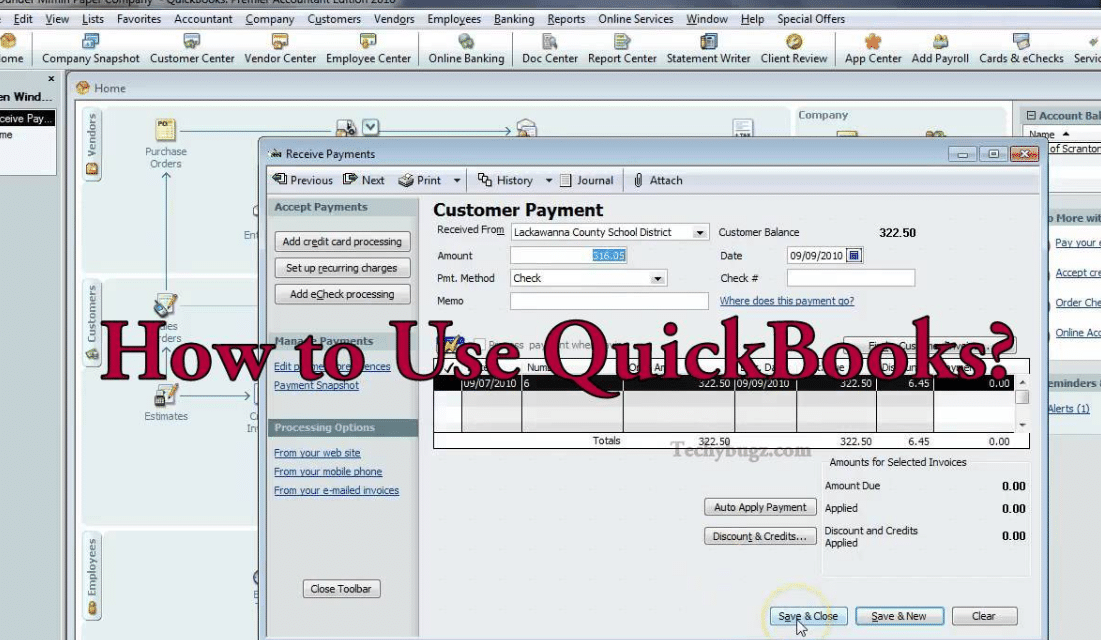

How To Use Quickbooks Online/Learn How To Use Quickbooks

Small business owners typically use QuickBooks to manage their invoices, pay their bills, and track their cash flows. They also use it to generate month- and year-end financial reports as well as prepare for quarterly or annual business taxes. It’s common for business owners to manage QuickBooks themselves or use an in-house or outsourced bookkeeper.

1. Manage Sales and Income

You can manage sales and income in QuickBooks by creating invoices to track sales by customer. Stay on top of what customers owe you (also known as your accounts receivable balance) by reviewing your Accounts Receivable Aging Report, which includes the details of both current and past due invoices. Below is a sample A/R Aging Report from Books.

2. Keep Track of Bills and Expenses

QuickBooks automatically keeps track of your bills and expenses by connecting your bank and credit card accounts to all of your expenses that are downloaded and categorized. If you need to track a check or cash transaction, you can record it directly in Books in just a few minutes.

QuickBooks will also help you pay your bills when they’re due. For example, you can ensure that you pay your bills on time by creating an Accounts Payable Report in under two minutes. This report will provide you with the details of your current and past due bills so that you can be sure to quickly address any issues. Below is a sample A/P Aging Report from QuickBooks.

3. Gain Key Reporting Insights to Your Business

By managing all of your cash inflow and outflow activities in QuickBooks, you are able to access several reports that provide valuable insights into your business. All of the reports are pre-built in QuickBooks and can be run in just a few clicks; reports are updated in real time as you enter and save transactions.

This can be beneficial if you need to provide financials to a potential investor or to your lender for a small business loan or line of credit. In addition to the Accounts Receivable Report and the Accounts Payable Report that we discussed previously, you can run the top three reports that you need in order to assess the overall health of your business:

- Profit and Loss Report

- Balance Sheet Report

- Statement of Cash Flows

Below, you will find a brief description of each of these reports along with a snapshot of what it looks like in QuickBooks.

Profit and Loss Report

The profit and loss report can be run in just a couple of minutes. It will show you how profitable you are by summarizing your income minus your expenses. It shows you your bottom line net income (loss) for a specific time period, such as a week, a month, or a quarter. Below is a Profit and Loss Report for the period of January 1 – September 29, 2016, for a fictitious company, Paul’s Plumbing.

Balance Sheet Report

The balance sheet report shows the Assets, Liabilities, and Equity of a business at a particular point in time. In just a few clicks, you can create a balance sheet report in QuickBooks. Below is a snapshot of a Balance Sheet report as of September 29, 2016, for a fictitious company, Paul’s Plumbing:

Sample Balance Sheet Report from QuickBooks

Statement of Cash Flows

You can quickly create a statement of cash flows in QuickBooks. This report will show you all of the activities that affect the operating, investing, and financing cash inflow and cash outflow for your business. Below is a snapshot of the statement of cash flows for the period January – September 2016 for a fictitious company, Paul’s Plumbing:

Sample Statement of Cash Flows Report from QuickBooks

4. Run Payroll

Payroll is an area that you don’t want to skimp on by trying to do it manually. Mistakes made in calculating paychecks can result in steep penalties and unhappy employees. To help, QuickBooks has its own payroll function that can automatically calculate and run payroll as often as you need it.

The best part about using QuickBooks payroll is that it is integrated with QuickBooks so your financial statements are always up-to-date as of the latest payroll run. The purchase of a QuickBooks payroll subscription is required so that you have access to the latest payroll tax tables to calculate employee and employer payroll taxes.

Some of the benefits of running payroll with QuickBooks are:

- Pay employees with a check or direct deposit

- Federal and state payroll taxes are calculated automatically

- QuickBooks fills in the payroll tax forms for you

- You can e-pay directly from QuickBooks

5. Track Inventory

If you need to keep track of the inventory you sell, such as on-hand amounts and unit costs, QuickBooks will automatically track and update this for you as you enter transactions. In QuickBooks, there are several reports available to manage inventory.

While keeping track of inventory is doable in an Excel spreadsheet, it can be very time-consuming. Below is a sample Inventory Valuation Summary Report from QuickBooks. This report shows a list of your inventory products, quantity on-hand, average cost, and their total value.

Sample Inventory Valuation Summary Report from QuickBooks

6. Simplify Taxes

If you’re still not convinced that you can simplify your taxes by using QuickBooks, just think about how much you dread tax season. Whether you have to consolidate several Excel spreadsheets or organize a shoebox full of receipts, it can take you longer to get your tax professional what they need than it takes to prepare your tax return!

Here at Fit Small Business, we use QuickBooks Online to manage all of our business accounting and taxes. We have set up our tax professional with a user id and password to access our QuickBooks data and pull the information they need to file our tax returns. Since everything is tracked in QuickBooks, we do not spend a lot of time organizing receipts and bank statements. This not only ensures that we have accounted for all income and expenses but also improves accuracy as a result.

7. Accept Online Payments

One of the best ways to improve your cash flow is to offer customers the option to pay their invoices online.

Once activated, all customer invoices that you send via email will include a “Pay Now” button. Your customer can click on that button and pay their invoice using any major credit card or by entering their bank account information to authorize an ACH payment directly from their bank account.

There is no monthly fee to use Intuit Payments; you simply pay per transaction as follows:

- Bank Transfers (ACH) – Free

- Card Swiped – 2.4% plus 25 cents

- Also, Card Invoiced – 2.9% plus 25 cents

- Plus, Card Keyed-in – 3.4% plus 25 cents

8. Scan Receipts

Another key to making tax time a breeze is being able to organize your receipts in QuickBooks. All QBO subscribers can download the QuickBooks App to their mobile device for free, take a picture of a receipt, and upload it to QBO in just a few minutes.

No more lost receipts or manually matching up receipts with downloaded banking transactions. QuickBooks allows you to attach a receipt to the corresponding banking transaction! You can upload an unlimited number of receipts to QBO to store in the cloud along with your data. This can be really helpful for companies who track a lot of expenses, like lawyers and law firms.

How To Use Quickbooks On 2 Computers

QuickBooks Online is a cloud-based product that does not require software installation. This QuickBooks product is available in three subscription levels (Simple Start, Essentials, Plus), and it is ideal for any service-based business that does not have complicated invoicing requirements. QBO allows you to access your data from any computer with an internet connection using your secure login.

Visit our free QuickBooks Course to sign up for a free trial and to learn how to use it.

QuickBooks Desktop

QuickBooks Desktop comes in three versions (Pro, Premier, Enterprise). All three versions of this QuickBook product require you to install software on your computer. QuickBooks Pro is ideal for most small businesses that do not manufacture products. Consequently, its Premium version is ideal if your business falls into one of these industries: manufacturing, contractor, retail, or nonprofit. However, QuickBooks Enterprise is for large enterprises.

These industry-specific versions of QuickBook include a custom chart of accounts and reports for these industries. We break down each of these products to help you understand what QuickBook is in our QuickBook Desktop comparison article.

QuickBooks Self-Employed

It is a cloud-based product that can be accessed from any computer with an internet connection and your secure login. It includes unique features that are not available in QBO and QuickBook Desktop, like the ability to separate business from personal expenses, track miles, and transfer data to TurboTax.

Read Also: What Is The Fraud Triangle?

QuickBooks Mac

QuickBook Mac (QB Mac) is the only desktop product available for Mac users. If you don’t want to go with QBO and you have a Mac computer, then you have to go with QB Mac. This product is very similar to QuickBooks Pro, and it is ideal for most small businesses that do not manufacture products. Check out our article on QuickBooks Mac to learn more about QuickBooks Mac.

How To Use Quickbooks 2018

Quickbook Online 2019 course updates are currently in progress and will be available to existing and new students as produced. The new material will provide learners with the most current look and format of QuickBooks Online.

We have listened to, and are grateful for, many reviews over the year and will implement many changes as we update the course including shortening unnecessary introductions, adding more ways for learners to work in a hands-on approach, and adding new content related to specific industries and circumstances including a cash basis business.

Would you like to learn QuickBooks Online to help run your business?

Interested in learning about QuickBook Online to advance your career?

Also, would you like to learn QuickBook Online to better understand how accounting concepts apply to real-world applications using real-world software?

If you are a student at an accredited academic institution, you may be eligible for a free trial version of QuickBooks from Intuit, which is a great tool allowing you to maximize the use of this course.

To locate this option, try an internet search for “QuickBook Free for Students.” Remember that we are looking for results from Intuit, the owner of QuickBook.

Why choose this course?

Comprehensive, current video content

Current video content means all QuickBooks lectures are done recently as of this post rather than adding a few new videos to content from prior years.

Who will we be learning from?

You will be learning from somebody who has technical experience in accounting concepts and in accounting software like QuickBooks, as well as experience teaching and putting together the curriculum.

You will be learning from somebody who is a:

- CPA – Certified Public Accountant

- CGMA – Chartered Global Management Accountant

- Master of Science in Taxation

- CPS – Certifies Post-Secondary Instructor

- Curriculum Development Expo

As a CPA and professor, the instructor has taught many accounting classes and worked with many students in the fields of accounting, business, and business applications.

Read Also: Smith And Wesson Stock

The instructor also has a lot of experience designing courses and learning how students learn best and how to help students achieve their objectives. Experience designing technical courses has also helped in being able to design a course in a logical fashion and deal with problems related to technical topics and the use of software like QuickBooks Pro.

How will we be Taught?

We will learn by doing, by providing a presentation, and providing the tools to work through the processes presented. Learning QuickBook is something best learned by doing, by applying skills to the QuickBook application.

Getting Started & QuickBook Online 2018 overview

- QuickBook Online Set-Up

Navigating Through QuickBook

- 1.15 Customers Section

- 1.20 Other Section

- 1.25 Employee Section

- 1.25 Other Section

- 1.35 Forms

- 1.35 Lists

- 1.40 Help Options

- 1.45 Pint & Export Reports

- 1.50 Backup Files

Double Entry Accounting System

- Double Entry Accounting System Overview

- Accounting Objectives

- Accounting Equation

Balance Sheet and Balance Sheet Options

- Balance Sheet & Balance Sheet Options Section

- 2.10 Balance Sheet

- 2.15 Balance Sheet General Options

- 2.20 Balance Sheet Remove Date Time

- 2.30 Balance Sheet Header & Footer

- 2.30 Comparative Balance Sheet

- 2.40 Summary Balance Sheet

- 2.50 Memorize Report

Income Statement & Statement of Equity

- Income Statement & Statement of Equity

- Statement of Owner’s Equity

- Balance Sheet & Income Statement Relationship

Profit & Loss / Income Statement

- Profit & Loss – Income Statement Overview

- 3.10 Profit & Loss

- 3.15 Income Statement Custom

- 3.20 Comparative Profit & Loss

- 3.25 Vertical Analysis Profit & Loss

- 3.30 Percent of Expense Profit & Loss